Discover How To PROTECT Yourself

From the IRS In Case You Get An

Income Tax Notice or Audit…

Sleep Better at Night Knowing You Don’t Have to Pay Thousands of Dollars

Or Waste MONTHS Of Your Time Dealing With The Tax Authorities…

Keep Reading to DISCOVER How to Have a Tax Professional At Your Side

For Just One Small Fee To Protect You In Case the IRS Comes Knocking…

Dear APCU Member,

Dear APCU Member,

You go to your mailbox, pull everything out, and look for something more exciting than the usual bills and junk mail, and then you see it—

an envelope with the return address “Internal Revenue Service” stamped on it. And this isn’t the one that has the clear window with your refund check showing through.

As you stare at the envelope, your heart starts to race, you break out in a sweat, and you start to pray (even if you aren’t religious) that it’s not bad news. You open the letter and it’s a notice that the IRS is either questioning items on your tax return, or you’re going to be audited. Worse yet, you find out someone stole your identity, filed a tax return in your name, and collected a fraudulent refund!

You might be wondering why you received this notice in the first place since you have a (CPA/EA/Attorney/Tax Professional) preparing your tax return. Here’s the truth—even if you have a professional preparing your tax return, you are subject to being audited for a variety of reasons, one of them being you were selected at random.

In 2021 thus far, the IRS has sent out over 9,000,000 “math error” notices relating to the Recovery Rebate Credits and Stimulus checks regarding the American Rescue Plan. All these notices requires a response.

In 2022, it’s estimated that the IRS will send out 15,000,000 notices regarding the Advanced Child Tax Credit Payments. All these notices will require a response as well.

While we make every effort to prepare your tax return as completely and accurately as possible, oftentimes there are missing items (such as 1099’s), and amounts of stimulus money or child tax credit payments we were not informed of at the time the return was prepared, which will draw the scrutiny of the IRS. Even people who have professionals prepare their returns are audited, or receive notices, and can benefit from our Client Care Package, which includes audit protection.

The fact is the letter the IRS sent you is claiming you owe them money, or claiming you didn’t report something properly, or claiming your refund is going to get reduced, or claiming something you reported shouldn’t have been reported. It’s not a fact. They want to talk to you and ask you more probing questions; are you prepared to answer them? Or what if they say one or even several of your deductions are not allowed to be taken; are you prepared to tell them otherwise?

In a moment I’m going to tell you how to eliminate the stress and worry of what to do when you receive an IRS or State income tax notice, because, let’s face it, when it comes to the IRS, you’re guilty until proven innocent. How are you supposed to make sense of the letter they sent you that can be anywhere from 2 to 11 pages that’s filled with verbiage that’s pretty much intended for an expert to understand?

Sure, you might think, “I’ll just call the phone number on the notice and see what this is all about,” but be prepared that you’re about to start a very long period of wasted time dialing, being put on hold, and even being hung up on. That’s right—you can be waiting on the phone for 60 minutes and then they hang up on you! The IRS calls this a “courtesy” disconnect. Please explain to me what is courteous about someone hanging up on you? This scenario is the “rule”, not the exception.

What if the IRS wants to do a full-blown audit?

What if the IRS wants to do a full-blown audit?

Many times, the IRS wants you to go to their offices. Do you want to go down to the IRS office by yourself, pass through security as tight as an airport terminal, then meet with an IRS agent who will show you his badge that lets you know he’s in charge? He will then lead you to a conference room and proceed to ask you 54 very invasive questions about your affairs that you are expected to answer on the spot. Are you prepared to answer those questions? Do you have any idea what those questions will be?

This is serious stuff, and you better remember that old adage, “What you say here can and will be used against you.” Talking to the IRS yourself is the WORST thing you can do.

Would you go to court without a lawyer? Then why would you face the IRS without expert help?

Would you go to court without a lawyer? Then why would you face the IRS without expert help?

The IRS auditor then asks to see your records, and if you give him your credit card statements showing your office supply charges or other deductions, he will tell you, “This isn’t the right proof.” What does he mean, “It’s not the right proof”? He expects if you are representing yourself you should know the 70,000+ pages of regulations.

(As an aside, did you know that the IRS hires many auditors off the street with barely any knowledge of tax law? Are you ready to put one of the most stressful moments of your life, and your finances, in the hands of some neophyte that just went through a quick training? How are you supposed to know they know what they’re doing?)

Here’s another scenario: what if you file your taxes and you get a notice in the mail that says, “We cannot process your income tax return because we already have one on file for you.”

Here’s another scenario: what if you file your taxes and you get a notice in the mail that says, “We cannot process your income tax return because we already have one on file for you.”

That means that some fraudster stole your identity, mailed in a fake tax return in your name, and made off with a big fat refund check that was supposed to be yours.

How in the world are you supposed to prove that you are you? Are you going to “wing it” by representing yourself and hope that the tax authorities side with you? More than 643,000 taxpayers had their tax data stolen in 2017 and 2018 with $6.2 billion fraudulently claimed. So, yes, it happens a lot more than you realize.

Listen: the IRS has only one mission—to access and collect more money from you. They say that they are playing fair, but do you really believe that they have your best interests at heart? (The truth is, which the IRS will never fess up to, the agent’s annual review and performance incentives are based on how much more money they can squeeze from taxpayers like you.) The IRS has the power to garnish your wages and seize your bank accounts—something even the President of the United States cannot do.

With the stakes so high …

Can’t I just respond to the notice myself since the IRS is only asking for a few documents?

Even if the letter seems to be asking for something simple, you could damage your case without realizing it. We ask our clients to allow us to handle all of the contact with the tax authorities from start to finish, ensuring that the case is resolved as quickly and as early as possible.

Under law, only a CPA, an attorney, or an enrolled agent (a person that has been accredited by the IRS), or in limited situations the person who prepared the return, besides yourself, can legally represent you before the IRS.

That’s why having a seasoned (CPA/EA/Attorney/Tax Professional) such as MMULLEN & Associates PA LLC at your side is critical if the IRS comes knocking. Once we file a Power of Attorney form, the IRS must deal directly with us. We handle all communications and correspondence on your behalf and, if necessary, meet with the IRS revenue agent so you don’t have to.

It’ll cost you $3,500 to $10,000 plus to hire an expert to defend you in an audit

It’ll cost you $3,500 to $10,000 plus to hire an expert to defend you in an audit

We have an affordable plan that I will tell you about in a moment because one of the problems is that you’ll have to pay between $3,500 and $10,000 and up for a (CPA/EA/Attorney/ Licensed Tax Professional) to defend you in an audit. Think about it: that’s money that could be spent on a dream vacation with your family, home improvements, or to spoil your kids!

You see, many people think that responding to notices or IRS representation is automatically included in the tax preparation fee. Of course, if we do make an error, we will correct the issue and take responsibility for any penalties or actions with the IRS.

But responding to IRS and State income tax notices questioning items on your return and audit representation can range into the thousands of dollars. With the increase of all the tax law changes and the government stimulus plans, tax identity theft cases and the frequency of audits have increased over the past years, we are concerned about your well-being and have created a Package to protect you. The IRS wants your money—and they’re banking on you representing yourself so they can push you around and get more money out of you!

Not only that, but it pains us to see clients have to pay $3,500 and up to resolve a simple audit due to the time it takes to represent a taxpayer. And other small income tax notice issues usually take $300 to $500 or more to help resolve.

Finally, an inexpensive and easy way to protect your family from the high cost of an audit and IRS inquiries

Finally, an inexpensive and easy way to protect your family from the high cost of an audit and IRS inquiries

Imagine what it would be like to just call us up and tell us to “handle” any income tax notice or audit by calling and/or going to the IRS for you. And imagine you don’t have to pay an arm and a leg to get us to do it.

That’s right, you get to stay home. If the IRS sends you a notice, we’ll automatically file a “2848 Power of Attorney” on your behalf and will work with the IRS on the issue without any additional time investment or expense on your part.

That way you can go about your daily life knowing that you have a bona-fide expert professional on your side dealing with the IRS so you can sleep better at night.

This sure beats having to negotiate with the tax authorities yourself without knowing any of the tax law. Representing yourself is a surefire way of getting manhandled by the IRS and having to pay through the nose for back taxes and penalties.

This coverage is all a part of my Client Care Package. For a small annual fee that’s added to your tax preparation invoice, we’ll shield and protect you from ever having to deal with the tax authorities by yourself in case you get a notice from the IRS or state tax authorities questioning items on your return that we just filed for you. And if you ever have to meet with an agent in person, we’ll attend the meeting on your behalf. You don’t even have to go.

All this happens without any extra charges on your behalf, Isn’t that a relief?

All this happens without any extra charges on your behalf, Isn’t that a relief?

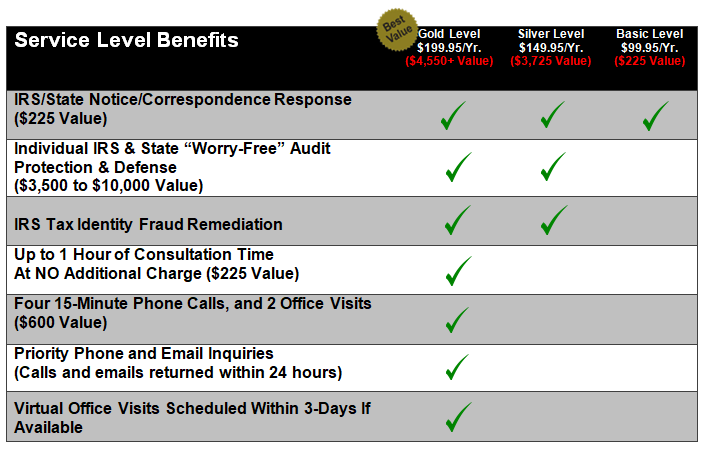

Beginning this year, when your return is prepared, we will determine which Client Care Package Service Level best fits your needs and this fee will be automatically added to your invoice. You have the option to “opt out” of the Package if you choose, and we will remove the amount from your invoice; otherwise, you can agree to the protection by paying the small annual fee.

However, if you choose to “opt out” and cancel the “worry-free” Client Care Package (which includes the Audit Protection Plan), you will be charged our usual hourly billing rates to handle ANY notices and inquiries from the IRS or state tax authorities. A simple response to the IRS/State can run you between $300 to $500.

Here are the different Client Care Package levels available:

Have a corporation or partnership and want them protected too?

We also offer the same protection for Corporations and Partnerships (Forms 1120, 1120-S 1065).

Please call us for information on our customized business client care packages and audit protection plans. You can sleep better tonight knowing you are protected from one of your biggest nightmares.

Sincerely,

Michael Mullen

Managing Partner

MMULLEN & Associates PA LLC

michael.mullen@mmullentax.com